Wholesale USDA Underwriting Guidelines

Product Detail and Guidelines

AUS

- GUS Approve / Accept recommendations are allowed.

- Manual downgrades are allowed; however, the Approve/Accept recommendation findings must

be included in the file. - Manual underwrites are allowed. Loans must be run through GUS first and receive a Refer

recommendation. The Refer findings must be included in the file.

Age of Docs

- 120 days for existing and new construction from the date the note is signed.

- Document age is measured from the date of the document to the date the note is signed. Credit

documents include all income, employment, asset information, and credit reports. - Preliminary Title Policies must be no more than 180 days old on the date the Note is signed.

Amortization Type

- Fixed

Appraisals

- Appraisal transfers are not allowed.

- The appraisal has a term of 120 days for existing and new construction.

- The term of the appraisal begins on the day the home is inspected by the GHS appraiser.

- Appraisals cannot be re-used after the mortgage for which the appraisal was ordered has closed.

- A new appraisal is required for each refinance transaction requiring an appraisal.

- A 30-day extension per USDA guidelines is allowed.

- Unpermitted Property Additions

- Properties with “unpermitted” structural additions are allowed under the following conditions:

- The subject addition complies with all investor guidelines;

- The quality of the work is described in the appraisal and deemed acceptable (“workmanlike quality”) by the appraiser;

- The addition does not result in a change in the number of units comprising the subject property (e.g. a 1 unit converted into a 2 unit);

- If the appraiser gives the unpermitted addition value, the appraiser must be able to demonstrate market acceptance by the use of comparable sales with similar additions and state the following in the appraisal:

- Non-Permitted additions are typical for the market area and a typical buyer would consider the “unpermitted” additional square footage be part of the overall square footage of the property.

- The appraiser has no reason to believe the addition would not pass inspection for a permit.

Assignment of Mortgages

- All loans must be registered with MERS at time of delivery and a MERS transfer of beneficial

rights and transfer of serving right must be initiated by the Seller, within 24-hours of purchase.

Borrowers

- All Borrowers must have a social security number

- All Borrowers must have no CAIVRS claim

- U.S. Citizens

- Permanent resident aliens, with proof of lawful permanent residence

- Non-permanent resident alien:

- USDA guarantees mortgages made to non-permanent resident aliens provided that:

- The USDA office of jurisdiction must be contacted to confirm Borrower’s resident status is acceptable to USDA.

- The Social Security card cannot be used as evidence of work status. Although Social Security cards may indicated work status, such as “not valid for work purposes,” an individual’s work status may change without the changed being reflected on the actual Social Security card. For this reason, the Social Security card must not be used as evidence of work status, and the EAD must be used instead.

- If the Borrower has < 2 years within the US, a copy of the Passport used to enter the country and a copy of the 1-94 issued by USCIS are required.

- If the Borrower has ≥ 2 years within the US, a copy of the current and previous EAD card is required.

- When utilizing a visa, a copy of the unexpired visa and copy of the passport must be included in the loan file.

- I-797 documents can be utilized in lieu of VISA if it meets the following criteria:

- I-797 evidences an approval for an acceptable VISA class

- The approval term is not expired

- Visa extension is current with an end date that meets Gold Star policy.

- I-797 documents can be utilized in lieu of VISA if it meets the following criteria:

- Borrowers residing in the U.S. by virtue of refugee or asylum status granted by USCIS are automatically eligible to work in this country. An EAD is not required.

- Immigration Classifications and VISA categories can be found on the USCIS website.

- Non U.S. citizens must be submitted through SAVE

- USDA guarantees mortgages made to non-permanent resident aliens provided that:

Buy downs

- No Temp Buy downs.

Condominiums

- Approved Fannie Mae (FNMA), Freddie Mac (FHLMC), HUD, or VA approved Condominium (Detached, Attached)

- Evidence of the attached condominium project’s approval by one of these four entities must be in the file.

Credit

- Non-Traditional Credit is permitted; however, primary Borrower must have one score derived from three-in-file merged credit report.

- At least one Borrower whose income or assets are used for qualification must have two trade lines that have existed 12-months. This policy applies to loans approved through GUS.

Derogatory Credit

- Follow USDA guidelines

Documentation

- Full

Down Payment Assistance

- Mortgage Credit Certificates (MCCs) are allowed for eligible borrowers but CANNOT be used for qualifying.

Employment/Income

- Follow USDA guidelines

- A verbal verification of employment is required.

- To determine if the Borrower’s income is eligible, visit: http://eligibility.sc.egov.usda.gov.

Escrow Holdbacks

- If the escrow holdback was due to appraiser required repairs, a copy of form 1004D – Certificate of Completion must be secured.

Escrow / Impounds

- An impound account for collection of taxes and insurance (or additional escrow items) is required. Escrow Waivers not permitted.

Exclusionary Lists

- All Borrowers must be screened by CAIVRS to determine there have been no late payments on Federal debt obligations.

- The HUD Limited Denial of Partnership (LDP) list and the General Services Administration (GSA) lists must be reviewed for all borrowers, sellers, realtors (listing and selling agents), loan officers or builders.

FICO / Credit Score

- 620

Guarantee Fee

- Guarantee Fee of 1.00% of the Total Loan Amount;

- Annual premium is .35% of the Total Loan Amount

High Cost / High Priced

- Not allowed

Income

- Per IRS regulations, income derived from trafficking in controlled substances is illegal, and under federal law, marijuana is a controlled substance.

Lien Position

- First

Manufactured Home Pilot (Existing)

- States included in the pilot program are: CO, IA, LA, MI, MS, MT, NV, NH, NY, ND, OH, OR, PA,

SD, TN, TX, UT, VT, VA, WA, WV, WI and WY - The unit must have been constructed on or before January 1, 2006, in conformance with the Federal Manufactured Home Construction and Safety Standards (FMHCSS), as evidenced by an affixed Housing and Urban Development (HUD) Certification Label.

- The unit inspection is required using one of two methods:

- Form HUD-309, “HUD Manufactured Home Installation Certification and Verification

Report” completed in accordance with 24 CFR 3286.511 by a qualified party as follows:- A manufactured home or residential building inspector employed by the local authority having jurisdiction over the site of the home, provided that the jurisdiction has a residential code enforcement program

- A professional engineer

- A registered architect

- A HUD-accepted Production Inspection Primary Inspection Agency (IPIA) or a Design Approval Primary Inspection Agency (DAPIA)

- An International Code Council (ICC) certified inspector

- Obtain a certification that the foundation design meets HUD Handbook 4930.3, “Permanent Foundation Guide for Manufactured Housing (PFGMH).” The foundation certification must be from a licensed professional engineer, or registered architect, who is licensed/registered in the state where the manufactured home is located and must attest to current guidelines of the PFGMH. The certification must be site specific and contain the engineer’s or registered architect’s signature, seal and/or state license/certification number. This certification can take the place of Form HUD 3.09.

- Form HUD-309, “HUD Manufactured Home Installation Certification and Verification

- The unit must not have had any alterations or modifications to it since construction in the factory, except for porches, decks or other structures which were built to be engineered designs or were approved and inspected by local code officials.

- Loan applications submitted under the pilot must be manually underwritten.

- The unit must have a floor area of at least 400 square feet.

- The unit must meet the Comfort Heating and Cooling Certificate Value Zone for the location.

- The towing hitch and running gear must have been removed.

- Must be classified and taxed as real estate.

- The remaining economic life of the property must meet or exceed the 30 year term of the

proposed loan. - Must meet all other requirements for credit and income as indicated in the Handbook.

Maximum Loan Amount

- Conforming limit

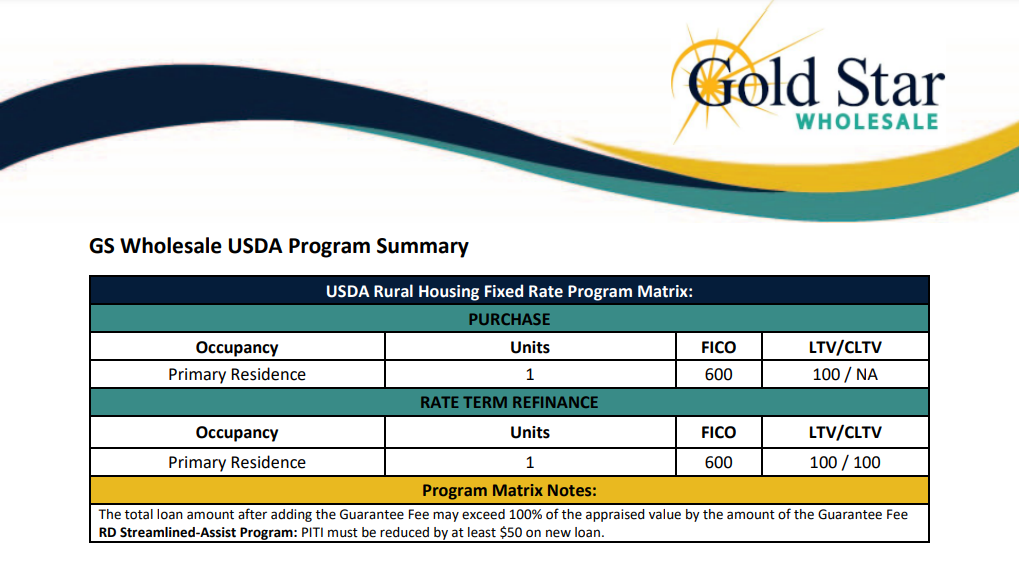

- The total loan amount after adding the Guarantee Fee may exceed 100% of the appraised value by the amount of the Guarantee Fee.

Occupancy

- Primary residence

Pre-Payment Penalty

- Pre-payment penalties are not permitted

Program Codes and Terms

- USDAF30

Property; Eligible Types

- 1 unit

- Single Family (Detached, Attached)

- PUD (Detached, Attached)

- Approved Fannie Mae (FNMA), Freddie Mac (FHLMC), HUD, or VA approved Condominium (detached, Attached). Evidence of the attached condominium project’s approval by one of these

four entities must be in the file - Modular Homes; must be built to BOCA Code

- Leasehold

- To determine if the borrower’s property is eligible, visit: http://eligibility.sc.egov.usda.gov.

Property; Ineligible Types

- In addition to the ineligible property types identified in HUD 4000.1, the follow property types are ineligible:

- Mobile homes

- Geodesic Domes

- Working Farms and Ranches

- Unimproved Land and property currently in litigation

- Income producing buildings. The property must not include buildings principally used for

income-producing purposes. Barns, silos, commercial greenhouses, or livestock facilities

used primarily for the production of agricultural, farming, or commercial enterprises are

ineligible. However, if these buildings are no longer in use for a commercial operation,

which will be used for storage do not render the property ineligible. Outbuildings such

as storage sheds and non-commercial workshops are permitted if they are not used

primarily for an income producing agricultural, farming, or commercial enterprise. A

minimal income-producing activity, such as maintaining a garden that generates a small

amount of additional income, does not violate this requirement. Home-based

operations such as childcare, product sales, or craft production that do not require

specific commercial real estate features are not restricted. - Acreage – site values must be typical for the area per the appraisal. Must be non-tillable or income producing.

- Multi-family (2 to 4 units)

- Cooperative

- Manufactured homes

- Rehabilitation loans

- Resale/Deed Restrictions

- Dwellings which are located closer than 300 feet to an active or planned oil or gas drilling site or closer than 75 feet to an operating well. This applies to the site boundary, not the actual well location.

- Properties located in lava flow zones 1 and 2

- Properties located in avalanche slide or run-out areas classified as Red Zones (black/extreme on some maps) or Blue Zones (red/high on some maps)

- Commercial Enterprises

- Boarding houses, hotels, motels, and tourist homes

- Condotels

- Fraternity/Sorority houses

- Private clubs

- Sanitariums

Ratio

- For GUS approved loans, ratios are determined by GUS

- For manually underwritten loans:

- Maximum 29/41 DTI

- Debt ratio waivers must be requested and documented in the file when the PITI is between 29 and 32 percent or the DTI ratio is between 41 and 44 percent. If a debt ratio waiver is not included in the file, the loan file will be denied.

Refinances

- Streamlined refinance

- A new appraisal is not required to refinance an existing guaranteed loan. A direct loan borrower will be required to obtain a new appraisal if they have received payment subsidy to determine the amount of subsidy recapture due. If subsidy recapture is due, the amount cannot be included in the new refinance loan. Subsidy recapture must be paid with other funds or subordinated to the new guaranteed loan.

- The maximum loan amount may include the principal and interest balance of the existing loan, and reasonable and customary closing costs, including financed portion of the upfront guarantee fee.

- Additional borrowers may be added to the new guaranteed loan. Existing borrowers on the current mortgage note may be removed, when one of the original borrowers remains on the refinance loan.

- The existing loan must have closed 12 months prior to the Agency’s receipt of a Conditional Commitment and have a mortgage payment history which must not reflect a delinquency equal to or greater than 30 days within the previous 180-day period.

- Lenders may request a debt ratio waiver when strong compensating factors are documented in accordance with Chapter 11 of the Handbook

- GUS may be utilized to underwrite the streamlined refinance loan.

- Streamlined-assist refinance

- A new appraisal is not required for existing guaranteed loan borrowers. A direct loan

borrower will be required to obtain a new appraisal if they have received payment

subsidy to determine the amount of subsidy recapture due. If subsidy recapture is due,

the amount cannot be included in the newly refinanced loan. Subsidy recapture must be

paid with other funds or subordinated to the new guaranteed loan. If an applicant elects to finance the subsidy recapture into the new refinance loan, refer to the non-streamlined

refinance guidelines. - The maximum loan amount may include the principal and interest balance of the existing loan, and reasonable and customary closing costs, including any financed portion of the upfront guarantee fee.

- The borrower must receive a tangible benefit to refinance under this option. A tangible benefit is defined as a $50 or greater reduction in their existing principal, interest, and annual fee monthly payment compared to the existing principal, interest and annual fee monthly payment.

- The borrower is not required to meet the repayment ratio provisions as outlined in Chapter 11 of the Handbook.

- The existing loan must have closed 12 months prior to the Agency’s receipt of a Conditional Commitment request.

- The borrower is not required to meet all the credit requirements as outlined in Chapter 10 of the Handbook. Prior to the request for a Conditional Commitment, the existing mortgage payment history must not reflect a delinquency equal to or greater than 30 days within the previous 12 months. Lenders may verify mortgage payment history through a verification of mortgage obtained directly from the servicing lender or a credit report. When a credit report is ordered to determine timely mortgage payments, other credit account are not to be considered.

- Borrowers may be added; however, only deceased borrowers may be removed from the loan.

- GUS is unavailable for this product and these loans must be manually underwritten.

- A new appraisal is not required for existing guaranteed loan borrowers. A direct loan

Reserves

- No reserves are required for USDA financing

- Can be considered a compensating factor (When using depository accounts, lenders must use the lesser of the current balance or previous month’s ending balance)

- Note that gift funds cannot be used for reserves.

Sales Concessions

- Sales concessions cannot exceed 6% of the LTV/CLTV

Seasoned Loans

- Please refer to Gold Star’s Season Loan Policy located in the Gold Star Seller Guide for

requirements on loan-level price adjustments (if applicable).

Secondary Financing

- No secondary financing allowed on purchase or refinance transactions.

- Existing second liens must be re-subordinated on refinance transactions.

State Restrictions

- Loans for properties in Hawaii are not eligible.

- Texas 50 (a)(6) loans are not allowed.

Student Loans

- A fixed payment may be used when you document and verify the payment is fixed, the interest rate is fixed, and the repayment term is fixed. There must be no future adjustments to the terms of the payment.

- If the payment is subject to change such as payments for deferred loans, Income Based Repayment (IBR), Graduated, Adjustable, and other types of repayment agreements which are not fixed you must use one percent (.50%) of the loan balance reflected on the credit report.

Tax Transcripts

- Most recent two years tax transcripts required of all household members age 18 or older. 4506T must be completed at loan application.

- Generally, when the documentation used to verify income is from the same calendar period as

the tax transcript, the information must match exactly. However, if the income documentation

is from the current calendar year and the transcripts is from a prior year there can be acceptable

variances. If this variance exceeds 20%, document the rationale for using current income. - If tax transcripts are not available (due to recent filing) a copy of the IRS notice showing “No

record return filed” is required along with documented acknowledgement receipt (such as IRS

officially stamped tax returns or evidence that the return was electronically received) from the

IRS and the previous year’s tax transcript. - An additional 4506-T, signed at application and closing, is required for all GUS findings.

Term

- 30 year

Title Insurance

- Required

Transaction Types

- Purchase

- Rate/Term Refinance – must currently be USDA loan

- **Cash-out Refinances are NOT allowed.

Revised 2/8/2022

Comments

0 comments

Please sign in to leave a comment.