Wholesale Conventional Underwriting Guidelines

Product Details and Their Guidelines

·AUS

- Desktop Underwriter (D) with “Approve/Eligible” Findings;

- Loan Prospector (LP) with “Accept” Recommendation;

- Manual UW is not allowed.

·Ability to Repay/Qualified Mortgage Rule

- Gold Star will fund only Safe Harbor Qualified Mortgages as defined under HUD and the Dodd- Frank Wall Street Reform and Consumer Protection Act.

·Age of Documents

- For existing construction, credit documents must be no more than 120 days old on the date the note is signed, including credit reports and employment, income and asset documents;

- For new construction, credit documents must be no more than 120 days old on the date the note is signed, including credit reports and employment, income and asset documents;

- Preliminary Title Policies must be no more than 180 days old on the date the note is signed.

·Amortization Type

- Fixed

·Appraisals

- Appraisal transfers are allowed

- Transferred appraisals require XML and pdf versions provided by prior investor along with transfer letter when Must also have Gold Star SSR’s in file.

- DU Note: Determined by DU Findings. Property Inspection Waiver (PIW), through DU is acceptable.

- LP Note: Determined by LP Findings. Property Inspection Alternative (PIA), through LP is acceptable.

- Guidelines

-

- If the effective date of the appraisal is more than 120 days before the Note Date, an appraisal update with at least an exterior-only inspection is required. If the effective date of the appraisal is more than 12 months before the Note Date, a new appraisal with an interior and exterior inspection is required.

- If the effective date of the appraisal is more than 120 days before the Note Date, an appraisal update with at least an exterior-only inspection is required. If the effective date of the appraisal is more than 12 months before the Note Date, a new appraisal with an interior and exterior inspection is required.

-

Gold Star will fund loans secured by properties with “unpermitted” structural additions under the following conditions:

-

- The subject addition complies with all investor guidelines;

- The quality of the work is described in the appraisal and deemed acceptable (“workmanlike quality”) by the appraiser;

- The addition does not result in a change in the number of units comprising the subject property (e.g. a 1 unit converted into a 2 unit);

- If the appraiser gives the unpermitted addition value, the appraiser must be able to demonstrate market acceptance by the use of comparable sales with similar additions and state the following in the appraisal:

- Non-Permitted additions are typical for the market area and a typical Buyer would consider the “unpermitted” additional square footage to be part of the overall square footage of the property.

- The appraiser has no reason to believe the addition would not pass inspection for a permit.

- Recert of values in accordance with Agency guidelines are acceptable.

·Assets

- Follow AUS;

- When a bank account or asset statement indicates FBO (for the betterment of) or ITF (Trust Account) confirmation that the client of record has access to the account (is either the beneficiary or the trustee) is required.

- This can be satisfied by the following:

- Copy of the trust or trust certificate indicating they are the beneficiary or trustee;

- Their name matches the FBO account.

·Assignment of Mortgages

- All loans must be registered with MERS at time of delivery and a MERS transfer of beneficial rights and transfer of servicing right must be initiated by the Seller, within 24-hours of purchase.

·Borrower Eligibility

- All Borrowers must have a social security number

- U.S. citizens

- Non-owner occupied transactions cannot close in the name of a Trust

- Permanent resident aliens, with proof of lawful permanent residence

- Non-permanent resident alien:

- Primary residences and second homes only.

- A valid social security number is required. However, a social security card may not be used as evidence of employment eligibility.

- All non-permanent resident aliens must provide evidence of a valid, acceptable visa or EAD as listed within documentation requirements below.

- When utilizing an acceptable visa, a copy of the unexpired visa and a copy of the passport must be included in the loan file. The following are acceptable visa classifications:

- A Series (A-1, A-2, A-3) E Series 9E-1, E-2) Treaty Trader

- G Series (G-1, G-2, G-3, G-4, G-5) H-1, Temporary Worker

- L-1, Intra-Company Transferee

- TN, NAFTA Visa

- TC, NAFTA Visa

- I-797 documents can be utilized in lieu of a VISA if it meets the following criteria:

- I-797 evidence an approval for an acceptable VISA class

- The approval term is not expired

- Visa extension is current with an end date that meets Gold Star Home Loans policy.

- Employment Authorization Documents are permitted as long as the meet the following criteria:

- If the Borrower has <2 years within the US, a copy of a Passport used to enter the country and a copy of the I-94 issued by the USCIS are required.

- If the Borrower has > 2 years within the US, a copy of the current and previous EAD cards are required.

- Loans to non-citizens who have been granted political asylum require underwriting to non-permanent resident alien guidelines must provide:

- An unexpired Arrival and Departure Records (INS Form I-94): and

- Copies of their employment authorization documents.

- If the authorization for temporary residency status will expire within 3 months or if it is set to expire, confirmation from USCIS that employer has re-filed petition of extension is required. If there are no prior renewals, proof of a three year continuance must be determined, based on information from USCIS.

- An individual classified under Diplomatic Immunity, Temporary Protected Status, Deferred Enforced Departure, or Humanitarian Parole is not eligible.

- Non-permanent residents must be employed in the U.S. if income is used to qualify.

- If a non-permanent resident alien is borrowing with a U.S. citizen, it does NOT eliminate or reduce any documentation requirements.

- ITIN’s are not allowed

·Condominiums/PUDs

- Please see “State Restrictions” for guidance directed towards the State of Florida.

- Condominiums approved using Project Eligibility Review Service (PERS) must have a Final Project Approval.

- Condominiums approved using Fannie Mae Special Approval Designations (SAD) are not allowed.

- In all other cases follow Agency guidelines.

- Any project (condo, or PUD) for which the homeowners’ association is named as a party to pending litigation, or for which the project sponsor or developer is named as a party to pending litigation that relates to the safety, structural soundness, habitability, or functional use of the project is now allowed.

- Projects for which the lender determines that pending litigation involves minor matters are not considered ineligible projects, provided the lender concludes that the pending litigation has no impact on the safety, structural soundness, habitability, or functional use of the The following are defined to be minor matters:

- Non-Monetary litigation involving neighbor disputes or rights of quiet enjoyment;

- Litigation for which the claimed amount is known, the insurance carrier has agreed to provide the defense, and the amount is covered by the association’s insurance; or

- The homeowners’ association named as the plaintiff in a foreclosure action, or as a plaintiff in an action for past due homeowners’ association dues

- The Homeowners Association is the plaintiff in the litigation and the Seller has determined that the matter is minor with insignificant impact to the financial status of the Condominium Project.

·Construction to Permanent Financing

- One time closings cannot be delivered to Gold Star Home Loans until the construction is completed and the terms of the construction loan have converted to the permanent financing.

- LP loans: Can be closed as a purchase or rate term transaction. Allowed per Freddie guidelines.

- DU loans: Must be closed as a rate term transaction. The Borrower may have acquired the land through a purchase, inheritance, gift or divorce settlement. Follow Fannie Mae for additional guidelines

·Credit

- Any debt not reported on the credit report must be documented as being repaid in a satisfactory manner,

- Credit report inquiries: follow AUS

- Must pay off any existing judgments or tax liens

·Debt/Liabilities

- Determining Monthly Payments on Revolving Accounts:

- DU: If the credit report does not show a required minimum payment amount and there is no supplemental documentation to support a payment, 5% of the outstanding balance must be used as the Borrower’s recurring monthly debt obligation. Open 30-day charge accounts are not required to be included in the debt-to-income ratio, if sufficient assets are verified.

- LP: If the credit report does not show a required minimum payment amount for a revolving or open-end account and there is no supplemental documentation to support a payment, 5% of the outstanding balance must be used as the Borrower’s recurring monthly debt

- Determining Payment Amounts on Student Loans:

- SEE STUDENT LOAN PAYMENT CALCULATION TABLE

- Derogatory Credit

- Waiting Periods are as determined by AUS

- Extenuating circumstances are allowed with a DU approve/eligible

- Manual underwriting is not allowed.

·Documentation

- Full

- Determined by AUS

·Down Payment Requirements

- As determined by AUS

·Down Payment Assistance

- Allowed per Agency guidelines.

- Employer Assistance Homeownership (EAH) is acceptable in accordance with Agency guidelines.

- Mortgage Credit Certificates (MCCs) are allowed for eligible borrowers but CANNOT be used for qualifying.

·Employment/Income Verification

- For salaried employees the verbal verification of employment must be completed within 10 business days prior to the note date.

- For the self-employed Borrowers, the verbal verification of employment must be completed within 30 days prior to the note date.

- W-2 transcripts provided by the IRS may be used in place of IRS W-2’s.

- For Borrowers in the military, a military Leave and Earnings Statement dated within 30 days prior to the note date is acceptable in lieu of a verbal verification of employment.

- Projected income is allowed on purchase transactions of a primary residence only. If employment begins after the loan closes, the Borrower’s offer for future employment may be used to underwrite and close the loan. Additional requirements:

- Contract for future employment must be included in file.

- History of employment in the same field

- A paystub is not required at the time of closing; however, Gold Star cannot deliver the loan to our Investors (as they follow Fannie/Freddie guidelines) without the first paystub in the loan file. The loan cannot close until the Borrower’s employment has begun – and this is confirmed with a full VOE matching the amount indicated on the Offer Letter.

- Standard defective delivery fees apply.

- DU Only

- ARMs are not ineligible

- Provide a written analysis of the income used to qualify the Borrower on the Transmittal Summary or like document(s) in the file. An Income Analysis must be completed for self- employed Borrowers.

- Assets as a basis of qualification is acceptable per Agency guidelines.

- Government/Public Assistance Income (commonly known as Section 8) is not allowed.

·Escrow Holdbacks

- If adverse weather conditions prevent completion of the repairs, Gold Star will permit escrow accounts established by the Seller for postponed improvements provided they comply with Fannie Mae requirements. Please review Gold Star Escrow Holdback Policy for additional information.

- Additional requirements:

- Gold Star will issue a post funding condition for 1004D conforming completion will be placed on loans where appraisal is “subject to” completion of

- Gold Star will issue a post funding condition for a final title policy endorsement that ensures the priority of the first lien.

- DU Only

- ARMs are not eligible.

·Escrow Waivers

- Escrow accounts are required if LTV > 80%, except where prohibited by state law. (In CA, > 90% LTV) * Not permitted when delinquent real estate taxes are being paid off with a cash out refinance.

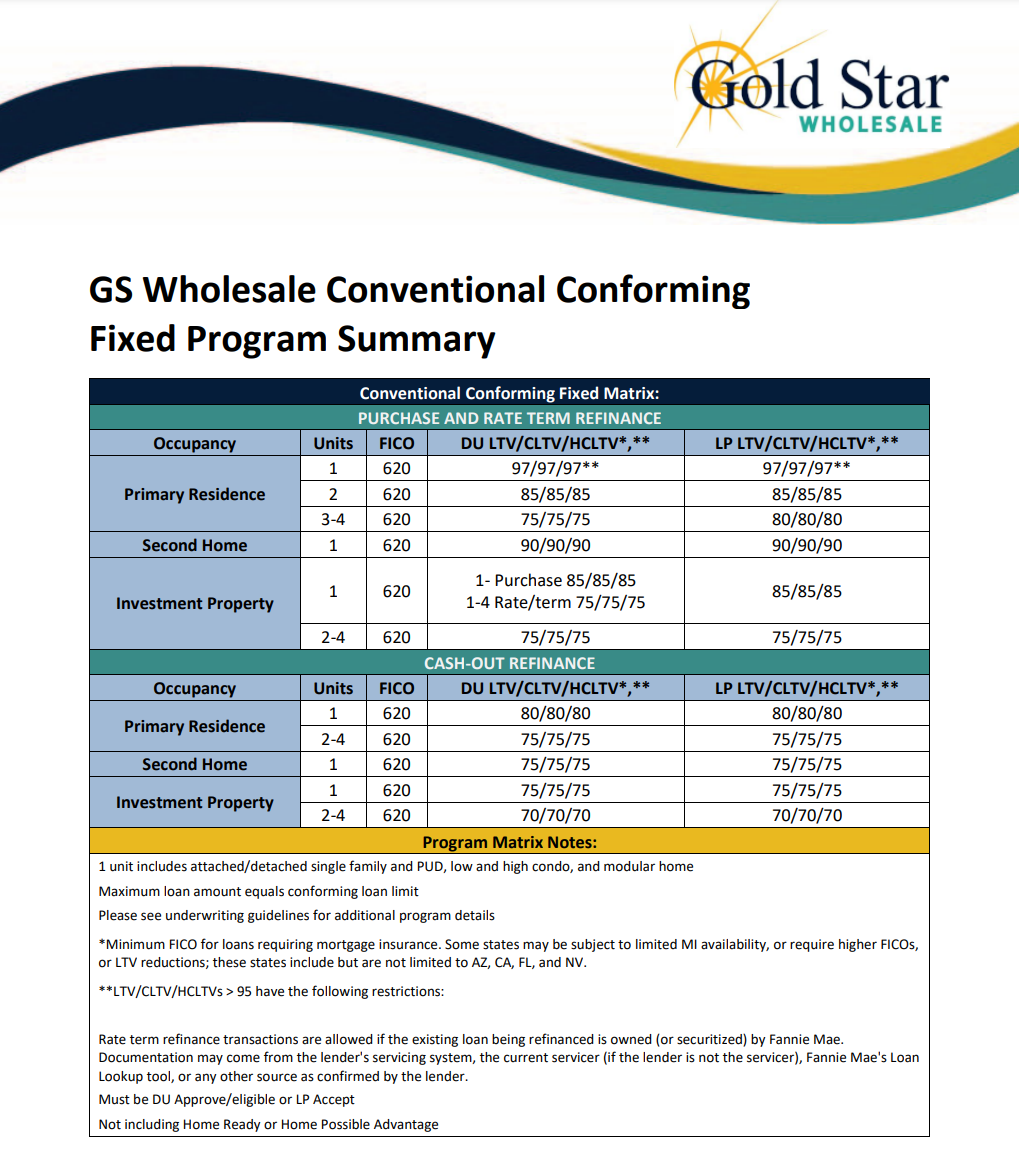

·FICO

- 620 regardless of AUS findings

- *Non-traditional credit considered when no FICO scores are available. Additional requirements must be followed

·Financing Concessions/ IPC

- Financing concessions for primary residences and second homes must be within the following allowable percentages:

- 9% of value with LTV/CLTV ratios less than or equal to 75%

- 6% of value with LTV/CLTV ratios greater than 75% up to and including 90%

- 3% of value with LTV/CLTV ratios greater than 90%-The maximum financing concession for investment properties is 2% of value regardless of the LTV ratio

- Value is the lesser of the sales price or appraised value

- DU: Property Seller cannot pay for future HOA dues

·High Cost/HPML

- Gold Star will not fund mortgage loans that fall within the rebuttable presumption standard unless they meet the residual income asset requirement

- Gold Star will not fund High Cost loans

·Income

- Per IRS regulations, income derived from trafficking in controlled substances is illegal, and under federal law, marijuana is a controlled substance. **W2 income is allowable – borrower cannot derive income from self-employment marijuana sales even in states where it is currently legal.

·Interested Party/Non-Arm’s Length Transactions

- Non-arm’s length transactions are purchase transactions in which there is a relationship or business affiliation between parties to the transaction such as family members, employer/employee, or principal/agent. This relationship may influence the transaction; therefore, at a minimum, Gold Star requires the following:

- These transactions include, but are not limited to:

- Family Sales or transfers

- Corporate sales or transfers

- Borrowers employed in the real estate or construction trades who are involved in construction, financing, or sale of the subject property.

- Some transactions involving principals or a lender or other vendor (such as an appraiser, settlement agent, or title company) who is involved in the lending process of the subject property.

- Non-arm’s length sales transactions are generally permitted for primary residences. However, if the Borrower is purchasing from a builder who is buying his or her existing residence, the transaction is not eligible for financing.

- Purchase of second homes and investment properties are not eligible for financing.

- Transactions must be fully disclosed as non-arm’s length and require close examination to ensure the equity position is not compromised.

- A non-arm’s length transaction is not permitted if the subject property is in foreclosure or a Notice of Default has been filled.

- Non-arm’s length transactions require full documentation for assets and income, regardless of the AUS (i.e. 2 years for income and 2 months for assets).

- The file must include all of the following documentation:

- Copy of the canceled earnest money check to verify payment to the seller.

- Verification that the Borrower is not now on title and has not been on title within the 24 months.

- Payment history for the existing mortgage (verification of seller’s mortgage) in the subject property must be obtained. It must show that the loan is paid current and has no pattern of delinquency within the past 12 months.

- Borrower must provide a written explanations stating the relationship to the Seller and the reason for purchase.

- The transaction must make sense and it must be apparent that the Borrower will occupy the property as a primary residence.

- A full appraisal must be obtained regardless of the AUS findings. The appraiser must be informed of the non-arm’s length transaction and address whether or not the market value has been affected by the relationship of the parties.

·Lien Position

- First

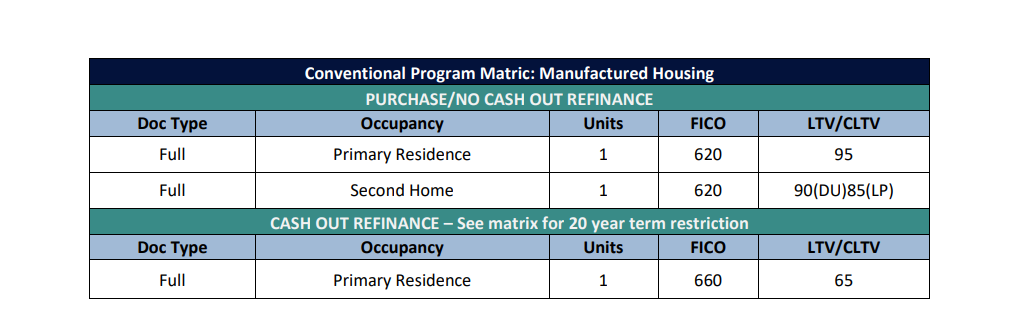

·Manufactured Housing

- Minimum FICO 620

- 65% Max LTV for Cash Out Refinances, repayment term not to exceed 20 years

- CU score must be greater than 4

- Must be multi-wide unit

- Must be attached to a permanent foundation

- Must be built/constructed on or after 06/01/1976

- Reduced MI is not allowed

- No repair escrows allowed

- Cash-out refinances are allowed

- Max LTV of 95 on purchases

- Primary Residence only

- No Leasehold

- Manufactured homes that have an addition or have had a structural modification are eligible under certain conditions. If the state in which the property is located requires inspection by a state agency to approve modifications to the property, then the lender is required to confirm that the property has met the requirement. However, if the state does not have this requirement, then the structural modification must be inspected and be deemed structurally sound by a third party who is regulated by the state and is qualified to make the determination. In all cases, the satisfactory inspection report must be retained in the mortgage loan file.

- New construction is not permitted; manufactured home must be installed onsite for at least 12 months prior to transaction

- No Flipping

- Must be US citizen or approved EAD/VISA, Foreign Nationals are ineligible

- Cannot pay off debt to qualify

- The unit must not have been previously installed or occupied at any other site or location, except for the manufacturer or the dealer’s lot as a new unit

·Maximum Loan Amount

- Conforming limit

·Minimum Loan Amount

- $25,000

·Mortgage Insurance

- Standard Coverage Required.

- Financed MI is The gross LTV cannot exceed Gold Star’s program maximum.

- Lender paid single premium and Borrower paid single premium MI is acceptable.

- Split Premium MI is acceptable. Split MI allows a portion to be collected upfront at closing, and a lesser monthly premium be added to the Borrower’s monthly mortgage payment. The upfront premium may be paid by the Borrower, Seller or a combination of both. Any amount paid by the Seller must be included in the maximum seller contribution calculation. A portion of the premium may not be financed. Split Premium MI is allowed up the max LTC for the product.

·Number of Financed Properties

- Borrowers may not have more than 10 financed properties on second home and investment property transactions

- This limitation includes joint or total ownership and is cumulative across all Borrowers on the loan including Borrowers who are obligated on the note without being the owner of record. This must be manually applied on all loans, as applicable, regardless of AUS requirements.

- A minimum credit score of 720 is required for Borrowers that 7-10 financing

·Reserve Requirements

- LP requires 8 months of reserves, based on the monthly payment on each additional second home and/or 1-4 unit investment property that is financed and on which the Borrower is obligated.

- DU will now determine this by applying a specific percentage based on the number of financed properties to the aggregate of the outstanding unpaid principal balance (UPB) for all mortgages including HELOC’s. A financed property has been redefined as a residential one-to four-unit property with a mortgage for which the Borrower is personally obligated;

- The reserve calculation has been refined for the other financed properties and will now be determined by applying a specific percentage based on the number of financed properties to the aggregate of the outstanding unpaid principal balance (UPB) for all mortgages and HELOCs:

- 2% of the aggregate UPB if the Borrower has 1 to 4 financed properties

- 4% of the aggregate UPB If the Borrower has 5 to 6 financed properties

- 6% of the aggregate UPB if the Borrower has 7 or more financed properties

- The following table describes how to apply the limitations based on the type of property ownership:

- Occupancy

- Primary Residence – 1-4 units

- Second home – 1 unit only

- Investment Property – 1-4 units

- Borrower Financing a Home For a Disabled Child or Elderly Parent

- Borrowers looking to finance a home for a physically handicapped or developmentally disabled adult child or an elderly parent who is unable to work or who may not have sufficient income to qualify for a mortgage on their own are acceptable.

- The occupancy type may be considered a primary residence in the following situations with acceptable documentation:

- If the parent is unable to work or does not have sufficient income to qualify for a mortgage on his or her own, the child is considered the owner/occupant. The child does not have to occupy the property.

- If the child is unable to work or does not have sufficient income to qualify for a mortgage won his or her own, the parent is considered the owner/occupant. The parent does not have to occupy the property.

- If parents are financing for a disabled child or children financing for elderly parents, the following applies:

- The disabled child or elderly parents are not required to be on title or on the mortgage loan,

- “elderly parents” are defined as parents who are not able to work or have insufficient income to afford a home on their own (no minimum age requirement),

- The loans are eligible as purchases, limited cash-out refinances and cash-out refinances, and

- Acceptable documentation must be included in the loan file to support the transaction.

- This includes, but is not limited to, tax returns of the Borrower which show the disabled adult child as a dependent or tax returns of the elderly parent(s) which documents insufficient income to qualify.

·Points and Fees

- Lenders may not charge Borrowers points and fees (whether or not financed) in an amount that exceeds the greater of:

- 5 percent of the principal amount of the mortgage loan, or

- $1,000

- Points and fees must be adequately disclosed in accordance with applicable law and regulation.

·Property Flipping Policy

- Properties acquired by the Seller within 180 days preceding the current sales contract for arm’s length transactions are allowed.

·Property Types

- Eligible:

- Single Family (Detached, Attached)

- PUD (Detached, Attached)

- Condominium – Warrantable (Detached, Attached)

- Modular Home

- Manufactured homes (built on a permanent chassis and attached to permanent foundations)

- Rural Properties (in accordance with agency Guidelines, loans must be residential in nature)

- LP loans must provide Freddie Mac Ground Lease Analysis (Form 461)

- 2-4 Units

- Ineligible:

- Mobile Homes

- Condominium Conversions that were converted within the last three years

- Condotels/Hotel Condominiums or PUDs

- Cooperatives

- Timeshares

- Geodesic Domes

- Working Farms and Ranches

- Unimproved Land

- Land Trust

- Condition Rating of C5/C6 or a Quality Rating of Q6.

·Ratio

- Determined by AUS

·Recently Listed Properties

- The subject property must not be currently listed for sale. It must be taken off the market on or before the application date. Borrowers must confirm their intent to occupy the subject property (for principal residence transactions).

·Rental Income Calculation

- History of managing rental properties: follow Agency guidelines.

- Net rental income or loss calculation follow Agency guidelines.

·Reserves

- Primary Residence – Follow AUS findings.

- Second Homes – Follow AUS findings. However if the Borrower owns additional financed second homes or investment properties, then 2 months PITI required, regardless of the AUS decision, on each second home or investment property.

- Investment – Follow AUS findings. However if the Borrower owns additional financed second homes or investment properties, then 2 months PITI required, regardless of the AUS decision, on each second home or investment property.

·Seasoned Loans

- Please refer to the Gold Star’s Seasoned Loan Policy located in the Gold Star Seller Guide for requirements and loan-level price adjustments (if applicable).

·State Restrictions

- Loans for properties in Hawaii are not eligible.

- Illinois Land Trusts are not eligible.

- LTV/CLTV restrictions are based on the condo approval type:

·Student Loan Payment Circumstance and Associated Guidance

- Fannie Mae

- If a payment amount is provided on the credit report, that amount can be used for qualifying purposes. If the credit report does not identify a payment amount, you can use either 1% of the outstanding student loan balance, or a calculated payment that will fully amortize the loan based on the documented loan repayment terms.

- When a credit report reflects a $0 payment the lender must obtain documentation to evidence the actual monthly payment is $0. If the $0 payment is due to an income- driven repayment plan the lender may qualify the Borrower with the $0 payment.

- **Does not apply to loans in deferment or forbearance**

- Freddie Mac

- Student Loans in Repayment

- For Students Loans in Repayment, use the greater of:

- The monthly payment amount reported on the credit report, or

- 5% of the original loan balance, as reported on the credit report, whichever is greater.

- Student Loans in Deferment or Forbearance

- For Student Loans in Deferment or Forbearance, use the greater of:

- The monthly payment amount reported on the credit report, or

- 5% of the original loan balance or the outstanding balance, as reported on the credit report, whichever is greater.

- Student Loan Forgiveness, Cancellation, Discharge and Employment-contingent Repayment Programs

- The student loan payment may be excluded from the monthly debt payment-to- income ratio provided the mortgage file contains documentation that indicates the following:

- The student Loan has 10 or fewer monthly payments remaining until the full balance of the student loan is forgiven, cancelled, discharged or in the case of an employment-contingent repayment program, paid, or

- The monthly payment on a student loan is deferred or is in forbearance and the full balance of the Student loan will be forgiven, cancelled, discharged or in the case of an employment-contingent repayment program, paid, at the end of the deferment or forbearance period.

- The student loan payment may be excluded from the monthly debt payment-to- income ratio provided the mortgage file contains documentation that indicates the following:

- For Student Loans in Deferment or Forbearance, use the greater of:

- For Students Loans in Repayment, use the greater of:

- Student Loans in Repayment

·Tax Transcripts

- Tax transcripts are required for the most recent year of income submitted in the file. W2 transcripts are allowed for salaried Borrowers.

- Generally, when the documentation used to verify income is form the same calendar period as the tax transcript, the information must match exactly. However, if the income documentation is from the current calendar year and the transcript is from a prior year, there can be acceptable If this variance exceeds 20%, document the rationale for using current income.

- If tax transcripts are not available (due to a recent filing) a copy of the IRS notice showing “No record of return filed” is required along with documented acknowledgement receipt (such as IRS officially stamped tax returns or evidence that the return was electronically received) from the IRS and the previous year’s tax transcript.

- A 4506-C, signed at application and closing, is required for all transactions per AUS guidelines.

·Term

- 10, 15, 20, 25, 30 years

·Transaction Types

- Purchase

- Limited Cash-Out/Rate & Term Refinance

- LP: Proceeds can be used to pay off a first mortgage as long as there is at least 120 days seasoning when the mortgage being refinanced was from a purchase money transaction (the note date of the mortgage being refinanced must be at least 120 days prior to the note date of the no cash-out refinance).

- DU: Proceeds can be used to Pay off a first mortgage regardless of age

- Proceeds can be used to pay off any junior liens related to the purchase of the subject property

- Pay related Closing Costs and Prepaid items

- Disburse cash out to the Borrower in an amount not to exceed 2% of the new Mortgage or $2,000, whichever is less.

- Cash Out

- 6 months seasoning required; measured from the date on which the property was purchased to the disbursement date of the new mortgage loan, unless delayed financing is met.

- Delayed financing provision is acceptable per Agency guidelines.

- All refinance transactions must meet Continuity of Obligation guidelines per Agency requirements.

- Restructured loans or short payoff refinances are not eligible.

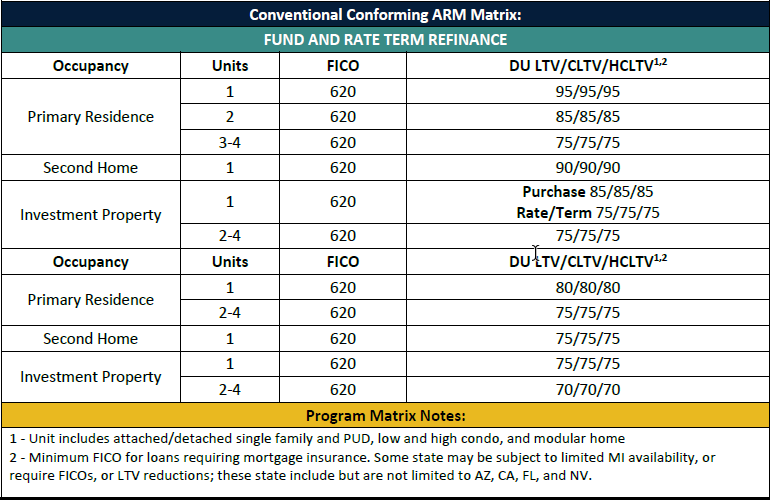

ARM Underwriting Guidelines

Product Detail and Their Guidelines

- AUS

- Desktop Underwriting (DU) with “Approve/Eligible” Findings

- Manual UW is not allowed.

- Ability to Repay/Qualified Mortgage Rule

- Gold Star will purchase only Safe Harbor Qualified Mortgages as defined under HUD and the Dodd-Frank Wall Street Reform and Consumer Protections Act.

- Age of Documents

- Amortization Type

- Adjustable Rate

- Appraisals

- PIWs not allowed.

- See Conforming Fixed Rate.

- ARM Qualifications

- Fully amortizing 3/1 ARMs & 5/1 ARMs: Qualify at the greater of the note rate +2%, or the fully indexed rate.

- Fully Amortizing 7/1 ARMs & 10/1 ARMs: Qualify at the higher of note rate or margin + index.

- Assignment of Mortgages

- Borrower Eligibility

- Caps

- 3/1 ARMs: 2/2/6

- 5/1 ARMs: 2/2/5

- 7/1 and 10/1 ARMs: 5/2/5

- Condominiums/PUDs

- Continuity of Obligation

- Credit

- Debts/Liabilities

- Derogatory Credit

- Documentation

- Full

- As determined by AUS

- Down Payment Requirements

- Down Payment Assistance

- Not allowed.

- Employment/Income Verification

- Projected income not allowed.

- See Conforming Fixed Rate.

- A paystub is not require at the time of closing; however, Gold Star cannot deliver the loan to our Investors (as they follow the Fannie guidelines) without the first paystub in the loan file. The loan cannot close until the Borrower’s employment has begun – and this is confirmed with a full VOE matching the amount indicated on the Offer Letter.

- Escrow Holdbacks

- Not allowed

- FICO

- All Borrowers must have a minimum of one credit sore to be eligible.

- 620 regardless of AUS findings.

- Financing Concessions

- High Cost / High Priced

- Not allowed

- Income

- Per IRS regulations, income derived from trafficking in controlled substances is illegal, and under federal law, marijuana is a controlled substance.

- Index

- 1 Year LIBOR

- Lien Position

- First

- Margin

- 2.25

- Maximum Loan Amount

- Conforming limit

- Minimum Loan Amount

- $25,000

- Mortgage Insurance

- Number of Financed Properties

- Gold Star will fund a maximum of 4 properties per Borrower.

- When the subject property is a primary residence, the Borrower may have unlimited financed properties.

- When the subject property is a second home or investment property, the Borrowers may not have more than 4 financed properties. (No exceptions)

- This limitation includes joint or total ownership and is cumulative across all Borrowers on the loan including Borrowers who are obligated on the note without being the owner or record. This must be manually applied on all loans, as applicable, regardless of AUS requirements.

- Occupancy

- Points and Fees

- Program Codes and Terms

- CL3, CL5, CL7, CL10

- Property Flipping Policy

- Not allowed

- Property Types

- Ratio

- Determined by AUS

- Recently Listed Properties

- Rental Income Calculation

- Reserves

- Seasoned Loans

- State Restrictions

- Tax Transcripts

- Term

- 30 Years

- Transaction Types

Comments

0 comments

Article is closed for comments.